Explore 5 ways how Agentforce boosts digital lending speed and efficiency. In today’s fast-paced financial world, Digital Lending is no longer a choice—it’s a necessity. Customers expect instant loan approvals, seamless digital experiences, and personalized offers. Traditional lending models, often reliant on manual processes and disconnected systems, slow down this journey. This is where Agentforce, built on Salesforce’s Financial Services Cloud (FSC), steps in to redefine efficiency.

Here are the top 5 ways Agentforce can transform digital lending operations:

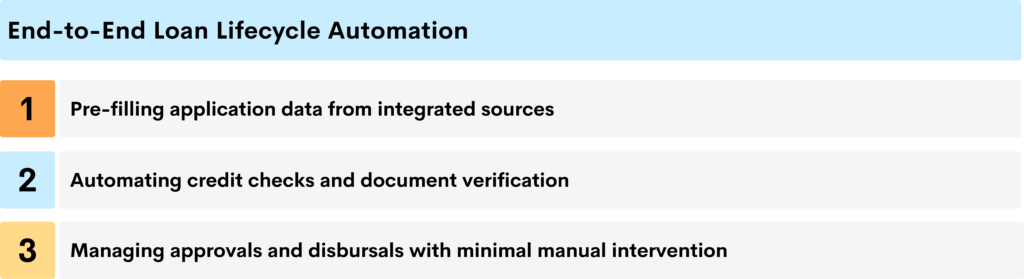

1. End-to-End Loan Lifecycle Automation

From loan application to disbursement, Agentforce automates repetitive tasks such as:

This reduces human errors, accelerates turnaround time, and improves customer satisfaction.

2. Intelligent Customer Interactions

Agentforce’s AI-driven agents engage with borrowers across multiple channels (chat, voice, portals), providing instant updates and personalized assistance.

This creates a smooth borrower experience while reducing dependency on human agents.

3. Unified Data & Smart Insights

Disconnected systems are one of the biggest challenges in lending. Agentforce integrates with Salesforce Data Cloud to unify structured and unstructured customer data. Paired with Einstein AI and Tableau, lenders can:

This empowers lenders to make data-driven lending decisions.

4. Streamlined Compliance & Risk Management

Agentforce connects seamlessly with external systems (like credit bureaus, regulatory databases, and KYC solutions). This ensures:

By reducing compliance risks, lenders can improve trust and operational security.

5. Scalable & Extensible Lending Operations

Whether you’re a retail bank, SME lender, or microfinance institution, Agentforce adapts to your needs. With low-code tools and MuleSoft integrations, lenders can extend capabilities to:

This ensures lenders remain agile in a competitive market.

Conclusion :

Agentforce isn’t just a tool—it’s a digital partner for lenders. By automating processes, unifying data, engaging customers, and ensuring compliance, it transforms digital lending into a faster, smarter, and more scalable ecosystem. Now you get what the 5 ways are—how Agentforce boosts digital lending speed and efficiency.

The result? Faster sales cycles, stronger customer relationships, and predictable growth.

At Intellicloud Solutions, we’ve seen firsthand how Revenue Cloud transforms organizations — from startups looking to streamline sales to enterprises reinventing their revenue models.

Because at the end of the day, revenue shouldn’t be complicated. With Revenue Cloud, it doesn’t have to be.

Ready to see how Revenue Cloud can work for your business? Let’s talk.