In financial services, the client onboarding journey is the first real impression a customer has of their bank, wealth advisor, or insurance provider. Yet, it is often one of the most complex and time-consuming processes—requiring document submissions, identity verification, compliance checks, and coordination across multiple departments. Traditionally, this process can take weeks, causing friction and dissatisfaction. That's where Salesforce introduced Agentic AI in to Client Onboarding.

Salesforce Financial Services Cloud (FSC) already streamlines onboarding with guided discovery and automation. Now, with the rise of Agentforce Agentic AI in to Client Onboarding —autonomous AI agents capable of executing multi-step workflows—financial institutions can reduce onboarding time from weeks to just days, all while delivering a digital-first, personalized experience.

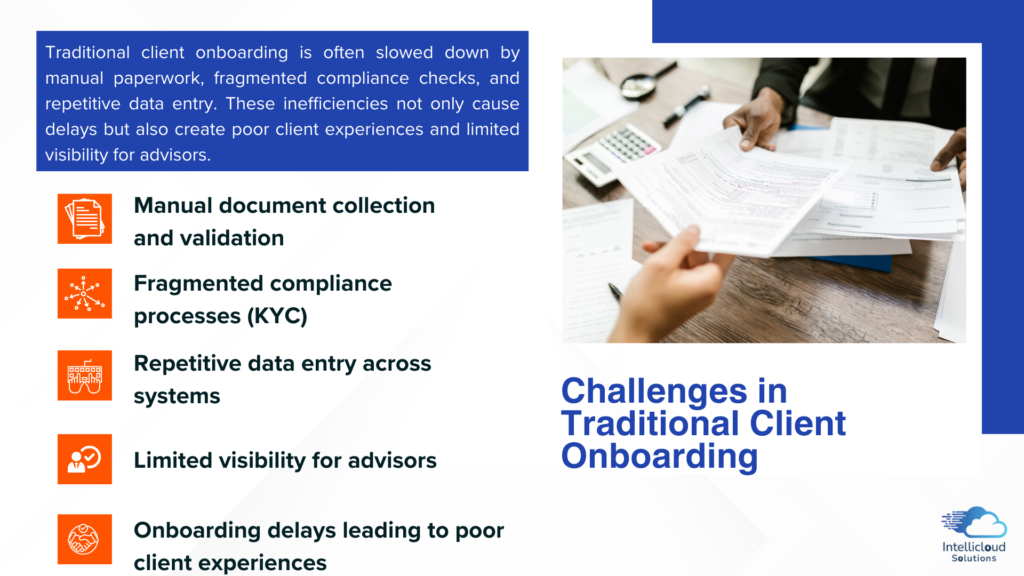

Challenges in Traditional Client Onboarding

What is Agentic AI?

Agentic AI refers to autonomous AI agents in Salesforce Agentforce that don’t just recommend actions—they execute workflows intelligently.

Within FSC, these AI agents can:

- Break down onboarding into actionable steps

- Automate document verification, risk checks, and account setup

- Trigger cross-system integrations (e.g., e-signature, KYC)

- Proactively handle exceptions and notify advisors

In essence, Agentic AI acts like a digital co-worker, orchestrating onboarding seamlessly from start to finish.

The Agentic AI–Powered Onboarding Workflow in FSC

Adviser Initiates Onboarding

Clients start their journey digitally by selecting products (savings, checking, insurance, lending). FSC captures intent from the first interaction and builds a guided onboarding pathway.

Automated Data Collection & Enrichment

Clients provide personal details through digital forms. AI agents guide them, pre-fill data where possible, and dynamically request additional information based on context.

Smart Compliance Checks

Agentic AI verifies uploaded documents with OCR and integrates with KYC providers. Discrepancies are flagged, and the system requests corrections or escalates issues automatically.

Cross-System Workflow Orchestration

Based on client needs and compliance clearance, FSC—powered by Agentic AI—matches them to products, generates agreements, and integrates with core systems for account creation. Flow Orchestrator, enhanced by AI agents, ensures correct sequencing and dependencies.

Personalized Advisor Console Updates

AI agents update the Advisor Console in real time, showing onboarding progress:

- KYC completed

- Account created

- Debit card issuance pending

Benefits of Agentic AI in Onboarding

- Faster Onboarding: Reduce cycle times from 2–3 weeks to 2–3 days

- Higher Accuracy: Minimize errors with automated data handling

- Advisor Productivity: More time advising, less time chasing information

- Client Satisfaction: Smooth, digital-first journey with real-time updates

- Scalability: Manage higher onboarding volumes without increasing headcount

Future Outlook

The future of FSC onboarding with Agentic AI could include:

- Predictive Journeys: Tailored onboarding steps based on client profiles

- Omnichannel Onboarding: Seamless onboarding via chat, WhatsApp, or voice

- Global Compliance Intelligence: AI agents adapting workflows dynamically to meet local regulations

Conclusion

By integrating Agentforce Agentic AI into Salesforce Financial Services Cloud, financial institutions can transform one of the most complex client experiences into a swift, intelligent, and delightful journey. The results speak for themselves: reduced onboarding times, improved client satisfaction, and enhanced advisor productivity—all powered by autonomous workflows.

👉 At Intellicloud Solutions, we specialize in building Salesforce-powered innovations for financial services. If your organization is looking to reimagine client onboarding with Agentic AI and FSC, contact us today to explore how we can help.