In today’s financial world, customers expect quick and easy access to credit. Digital lending makes this possible by automating loan processes and reducing paperwork, while Agentforce helps agents guide customers with the right information at the right time. Together, they make lending faster, more transparent, and more customer-friendly—helping financial institutions build trust and grow.

Key Highlights

- Accelerated Loan Approvals – Faster financial decisions through automation.

- Seamless & Secure Experience – Intuitive interactions with robust data protection.

- Personalized Financial Journey – Services tailored to individual needs.

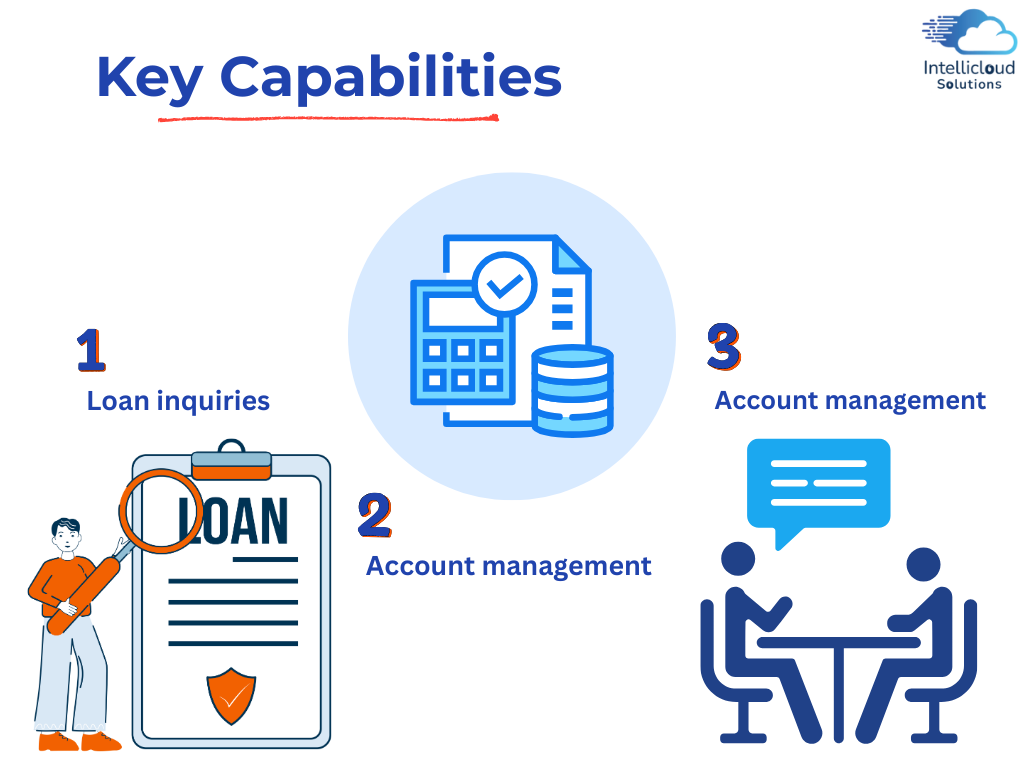

Core Capabilities of Financial Services Cloud

Centralizes banking, lending, and investment services on one platform.

Consolidates disparate systems for a unified financial view.

Enables cohesive and intelligent money management.

Forms the foundation for transformative digital lending.

Digital Lending Transformation

Digital lending is changing the way people access credit. It replaces paperwork with simple, paperless applications and gives customers real-time updates on their loan status. Approvals happen faster, funds are made available sooner, and the entire process feels seamless and stress-free. With strong security and reliable data protection, digital lending ensures both speed and peace of mind.

Vision

Our vision is to create a smarter, faster, and more connected lending experience. By combining the efficiency of digital lending with the customer-first approach of Agentforce, financial institutions can simplify loan processes, provide instant support, and deliver personalized guidance at every step. Together, they redefine lending—making it seamless, transparent, and built on trust.

Personalized Human Connection with Agentforce

Agentforce goes further than digital innovation—it strengthens the human connection. By enabling agents to interact with empathy and provide personalized guidance, it builds trust and ensures customers feel understood and supported. This balance of efficiency and human touch leads to deeper relationships and higher satisfaction.

Provides agents with comprehensive insights into customer profiles.

Tangible Benefits of Agentforce

Seamless Lending Process

Clients start their journey digitally by selecting products (savings, checking, insurance, lending). FSC captures intent from the first interaction and builds a guided onboarding pathway.

Enhanced Customer Service

Clients provide personal details through digital forms. AI agents guide them, pre-fill data where possible, and dynamically request additional information based on context.

Integrated Approach

Clients provide personal details through digital forms. AI agents guide them, pre-fill data where possible, and dynamically request additional information based on context.

A Supportive Banking Partnership

Agentic AI verifies uploaded documents with OCR and integrates with KYC providers. Discrepancies are flagged, and the system requests corrections or escalates issues automatically.

Conclusion

By combining Digital Lending with Agentforce, financial institutions can turn complex lending processes into a seamless, transparent, and customer-friendly experience. The impact is clear: faster loan approvals, stronger client relationships, and improved efficiency across the board.

👉 At Intellicloud Solutions, we help financial institutions unlock the full potential of Salesforce-powered solutions. If your organization is ready to transform lending with Digital Lending + Agentforce, connect with us to see how we can make it happen.