Customer onboarding is a crucial process in financial services, but it has traditionally been slow, manual, and compliance-heavy. With increasing customer expectations and stringent regulatory requirements, financial institutions need a more efficient and seamless onboarding experience. This is where Salesforce Financial Services Cloud Artificial Intelligence (AI) and automation come into play, revolutionizing the onboarding process to be faster, more secure, and highly personalized.

Challenges in Traditional Onboarding

The traditional onboarding process for banks, insurance companies, and wealth management firms often involves:

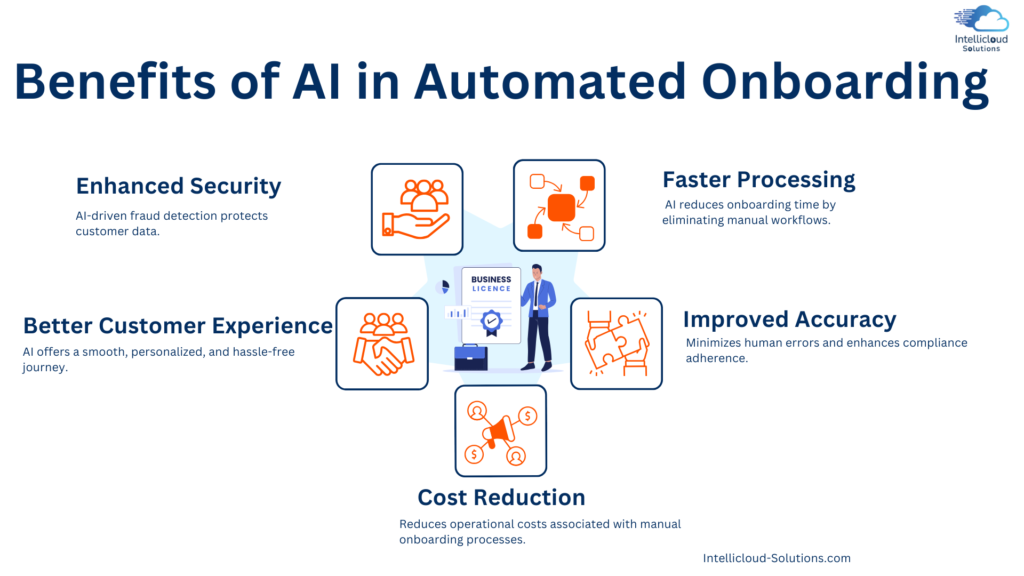

These inefficiencies result in higher operational costs, poor customer experiences, and compliance risks. AI-driven automation solves these challenges by streamlining and optimizing every stage of onboarding.

How AI is Transforming Onboarding in Financial Services

Intelligent Data Capture and Processing

AI-powered Optical Character Recognition (OCR) and Natural Language Processing (NLP) automate data extraction from documents such as passports, bank statements, and tax forms, reducing manual input and errors.

- AI-driven document verification speeds up Know Your Customer (KYC) checks.

- Eliminates redundant data collection and enhances accuracy.

AI-Driven Identity Verification & Fraud Detection

AI enhances identity verification by analyzing biometric data, facial recognition, and digital footprints, reducing fraud risks.

- Automated background checks cross-verify government databases.

- AI models detect suspicious activities and flag potential fraudsters.

Personalized Customer Journeys with AI Chatbots

AI-powered virtual assistants and chatbots guide customers through the onboarding journey, answering questions, collecting documents, and providing real-time assistance.

- AI chatbots reduce call center dependency.

- Offers 24/7 support for seamless onboarding experiences.

Risk Profiling and Compliance Automation

AI-driven analytics assess customer risk profiles in real-time by analyzing financial behavior, transaction history, and credit scores. Additionally, AI ensures compliance with regulations like GDPR, CCPA, AML, and KYC by automating audits and regulatory reporting.

- Reduces regulatory penalties.

- Ensures consistent compliance adherence.

AI-Powered Decision Making

AI helps financial institutions make faster onboarding decisions by analyzing customer data and providing recommendations based on predefined risk parameters.

- AI accelerates loan approvals and policy underwriting.

- Reduces onboarding time from weeks to minutes.

Final Thoughts

AI-driven automation is revolutionizing customer onboarding in financial services, offering speed, security, and compliance at scale. Financial institutions leveraging AI-powered onboarding solutions gain a competitive advantage by reducing friction, improving efficiency, and ensuring compliance.

As AI continues to evolve, the future of onboarding will become even more seamless, intelligent, and customer-centric. Now is the time for financial services firms to embrace AI and transform their onboarding experience!

Connect with us to discover how we can help you create fast, reliable solutions tailored to your business needs.

To learn more about our capabilities in Financial Services Cloud, we invite you to explore our profile and connect with us. Let us assist you elevate your business with innovative software solutions.